Form 8941: Small Employer Health Insurance Premiums Credit

Navigating the complexities of tax credits can be daunting for small business owners. However, understanding and utilizing Form 8941, the Credit for Small Employer Health Insurance Premiums can provide significant financial benefits.

This credit is designed to encourage small employers to offer health insurance coverage to their employees by reducing the overall cost of premiums.

In this article, we will walk you through the essentials of Form 8941, including eligibility requirements, the calculation process, and practical tips for filing.

What is Form 8941?

Form 8941, Credit for Small Employer Health Insurance Premiums, allows eligible small businesses and tax-exempt organizations to claim a tax credit for employee health insurance coverage premiums.

This credit is part of the Affordable Care Act (ACA). It is designed to make health insurance more affordable for small businesses and encourage them to offer health coverage to their employees.

The credit can be significant: up to 50% of premiums paid by small businesses and up to 35% for tax-exempt organizations. This cost reduction can be a critical incentive for small employers who might otherwise find it difficult to offer health insurance benefits.

Small Employer Health Insurance Credit eligibility criteria

Full-time Equivalent Employees

To qualify for the credit, your company must have fewer than 25 full-time equivalent employees. The calculation of FTE employees is as follows:

- Employees who work at least 30 hours per week.

- Add the total number of hours worked by part-time employees in a week and divide by 30 to convert to FTEs.

If you have two part-time employees who each work 15 hours per week, they count as one FTE employee.

Average annual salary

Your company's average annual wages must be $58,000 or less to qualify for the credit. This figure is adjusted annually for inflation. To calculate average annual wages:

- Add the total wages paid to all employees for the year.

- Divide this total by the number of FTE employees calculated in the previous step.

Contribution to the premium

To be eligible, your company must pay at least 50% of your employees' health insurance premiums. This percentage is based on the cost of single (employee-only) coverage, regardless of whether the employee has elected family coverage.

If the premium for single coverage is $5,000 per year, your company must contribute at least $2,500 per employee to meet this requirement.

Requirement for SHOP coverage

Generally, to qualify for the credit, you must purchase health insurance through the Small Business Health Options Program (SHOP).

However, there are exceptions for certain tax years, especially if the SHOP program isn't available in your area.

Exclusions from FTE calculations

Certain individuals and their family members are excluded from the FTE calculation. These include:

- owner of a sole proprietorship;

- partners in a partnership;

- S corporation shareholders with more than 2% ownership;

- owners of more than 5% of the company;

- family members of the above;

In addition, seasonal employees who work 120 days or less during the tax year are not included in the FTE calculation. However, the health insurance premiums paid for these employees are still included in the credit calculation.

Instructions for filling out Form 8941

Form 8941 has several worksheets to help you calculate the amount of the credit.

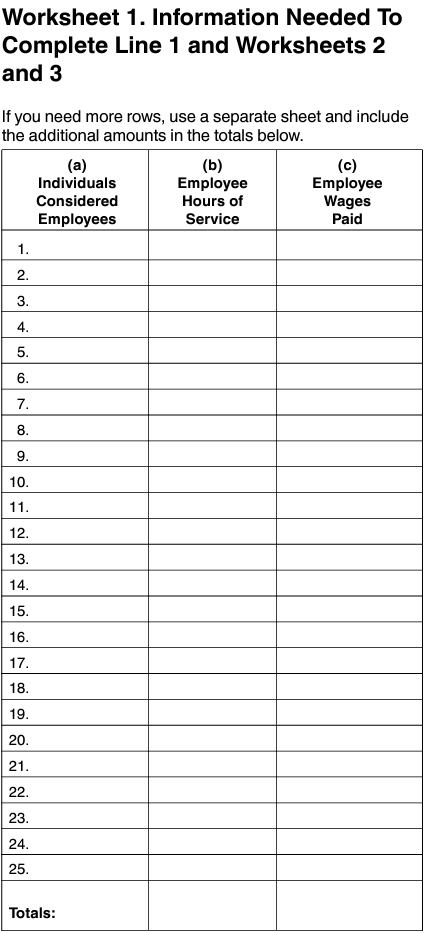

Worksheet 1: Employee details

This worksheet lists all employees and determines their health insurance status. You'll need to record the following information:

- employee names (column a);

- hours worked (column b);

- wages paid to employees (column c);

The total number of employees reported is used on line 1 of Form 8941. To complete this worksheet, obtain your employee and payroll information from your payroll processor or historical payroll records.

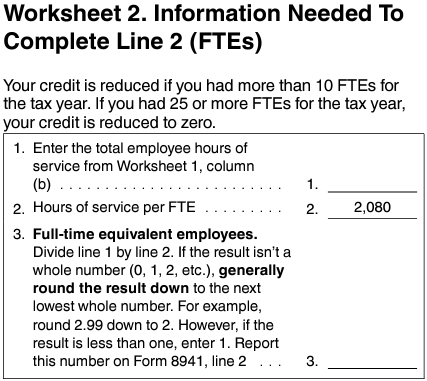

Worksheet 2: FTE calculation

On Worksheet 2, calculate the number of full-time equivalent (FTE) employees. This involves:

- Adding all the hours worked by part-time employees in a year.

- Divide the total hours by 2,080 (the number of hours in a full-time year).

Worksheet 2 is specifically for the FTE calculation. Use the total employee hours from Worksheet 1 and divide by 2,080. This gives you your FTE count, which you then enter on line 2 of Form 8941.

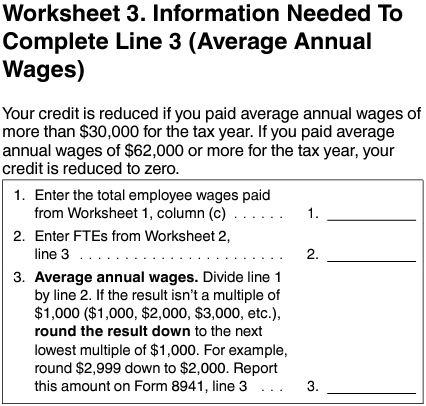

Worksheet 3: Average wages

Worksheet 3 helps you determine the average annual salary of your employees. You will need to:

- Add the total wages paid to all employees during the year (from Worksheet 1).

- Divide this total by the number of FTE employees (calculated on Worksheet 2).

Worksheet 3 helps you find the average annual wages per FTE.

Enter the final result on line 3 of Form 8941.

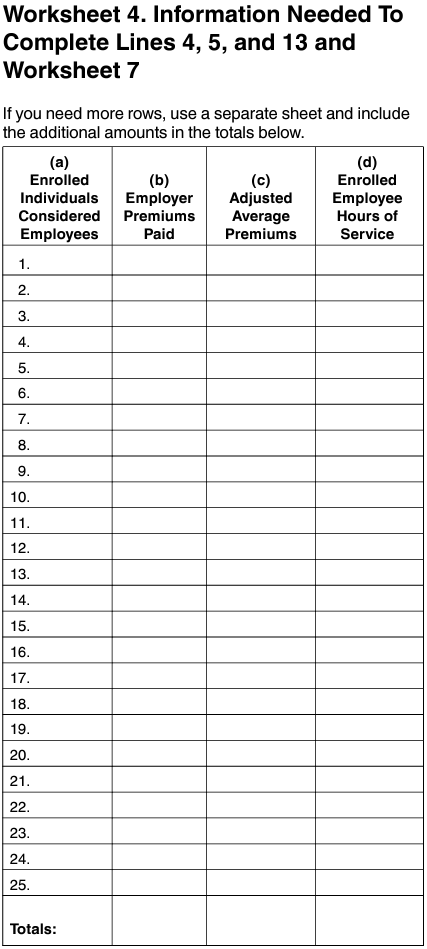

Worksheet 4: Premiums paid

Worksheet 4 requires you to document the total health insurance premiums paid by your business. Here's how to complete it:

- Total the employer-paid portion of health insurance premiums and hours worked for enrolled employees only.

- Columns (a), (b), and (d): Information you can probably find from your payroll processor or previous payroll records.

- Column (c): Find the average premium based on your location. Double-check the locations for businesses with multiple locations.

Once completed, complete lines 4, 5, and 13 of Form 8941. Also complete all spaces on Form 8941, lines 1 through 13, except for lines 8 and 9. The remaining worksheets need only be completed if certain conditions are met.

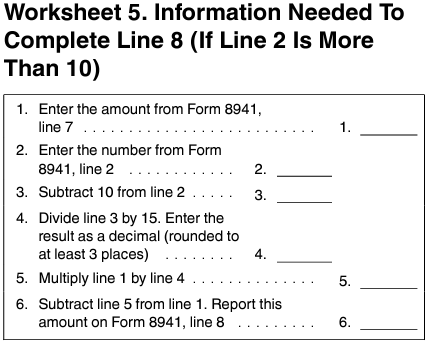

Worksheet 5: FTE and average wage adjustments

Worksheet 5 includes adjustments based on the number of FTE employees and average wages. The credit amount is gradually reduced if:

- You have more than 10 FTE employees.

- Average annual wages exceed $27,000.

- If the value you entered on line 2 of Form 8941 is greater than 10, you won't qualify for the full credit amount. You'll determine the adjusted credit amount by completing Worksheet 5.

- Start with the applicable percentage and FTE number from lines 7 and 2 of Form 8941.

- Subtract 10 from the FTE count to find the excess over the limit.

- Divide this amount by 15 and multiply by the percentage on line 7.

- Subtract this result from the original percentage to determine the allowable credit percentage of health insurance premiums paid.

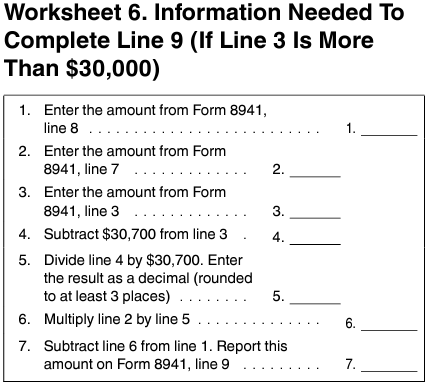

Worksheet 6: Determining the preliminary credit

Worksheet 6 calculates the preliminary credit before any adjustments. This includes:

- Calculating the total premiums paid by the employer.

- Multiplying this amount by the applicable percentage (50% for for-profit businesses, 35% for tax-exempt organizations).

Similarly, you won't be eligible for the full credit if your reported average annual wages exceed $28,000. If so, complete Worksheet 6:

- Begin with the percentage from Worksheet 5.

- Enter the starting percentage and the average annual wages.

- Subtract $28,700 from the average annual wages and divide by $28,700.

- Multiply the starting percentage by this decimal.

- Subtract this value from the starting percentage.

- Enter the result on line 9 of Form 8941.

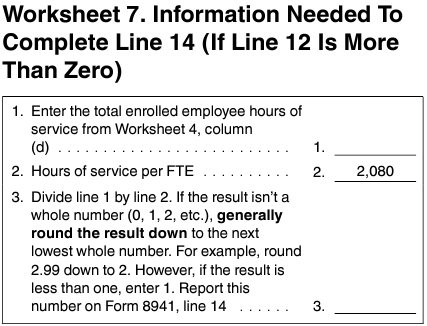

Worksheet 7: Final credit calculation

The final worksheet, Worksheet 7, determines the final credit amount after all adjustments. This includes:

- Applying the phase-out based on FTE employees and average wages.

- Ensuring that the final credit does not exceed the maximum allowable amount.

If line 12 on Form 8941 is greater than 0, complete Worksheet 7 to complete line 14. Unlike Worksheet 2, it only includes employees who are enrolled in the insurance program.

- Complete Worksheet 7 to calculate the value.

- Enter the calculated value on line 14 of the Form 8941.

- Review and complete any uncompleted lines to determine the final credit amount.

How to submit the form?

After completing all the worksheets, you will combine the calculations on Form 8941 and attach them to your business tax return. For most businesses, this means integrating the credit with Form 3800, General Business Credit.

Tax-exempt organizations use Form 990-T to claim the refundable credit.

Integration with Form 3800

When claiming the small employer health insurance premium credit, it's important to integrate Form 8941 with Form 3800, General Business Credit.

Form 3800 consolidates all of your business credits, including those from Form 8941, into a single form, simplifying the process of reporting and claiming various tax credits.

Steps for Integration:

- Calculate the credit using the steps and worksheets outlined above.

- Once the final credit amount is determined on Form 8941, transfer that figure to Form 3800.

- Enter the credit amount in the appropriate section of Form 3800. This will be part of your total general business credits.

- File Form 3800 with your annual business tax return to ensure that all credits, including those from Form 8941, are reported correctly.

Special reporting for tax-exempt organizations

Tax-exempt organizations have a slightly different process for claiming the small employer health insurance premium credit.

Instead of using Form 3800, these organizations must claim the credit on Form 990-T, Exempt Organization Business Income Tax Return.

Filing process for tax-exempt organizations

- Calculate the credit using the same steps as for for-profit businesses.

- Transfer the calculated credit amount from Form 8941 to Form 990-T.

- Unlike for-profit businesses, tax-exempt organizations can claim a refundable credit, which means they can receive a cash refund even if they owe no income tax.

- File Form 990-T with the IRS to ensure the credit is reported accurately.

Practical tips

Keeping accurate and comprehensive records is critical to verifying eligibility and accurately calculating the credit. Here's what you need to keep track of:

- Document all hours worked and wages paid to employees. This is essential for calculating full-time equivalent (FTE) employees and average annual wages.

- Keep detailed records of all health insurance premiums paid for your employees. Be sure to document both the total premiums and the portion paid by the employer.

- Record the amounts your company contributes to employee health insurance premiums. This information is necessary to meet the requirement of paying at least 50% of the premiums.

Accurate and organized records will not only make it easier to complete Form 8941 but will also help in the event of an IRS audit.

Focus on your business. Partner with professionals for taxes.

Book discovery callConclusion

Claiming the Small Employer Health Insurance Premium Credit through Form 8941 can provide significant financial relief for small businesses that offer health insurance.

For more detailed guidance, consider consulting with a tax professional and taking advantage of available IRS resources.

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. Always consult with a tax professional regarding your specific case.

Ines Zemelman, EA, is the founder and president of TFX, specializing in US corporate, international, and expatriate taxation. With over 30 years of experience, she holds a degree in accounting and an MBA in taxation. See more

Further reading