Guide to S corp taxes [+ 25 FAQs answered by tax pros]

![Guide to S corp taxes [+ 25 FAQs answered by tax pros]](https://tfxstorageimg.s3.amazonaws.com/v3ssps2q2k4f44tp0oxyhhh2jnls)

S corporation taxation is usually quite challenging for small business owners. However, knowing the benefits and requirements of an S corp can greatly benefit your business in both the short and long term.

This guide explains what distinguishes S corporations from other tax statuses and offers tips on reducing your business tax bill. Additionally, tax experts from TFX, a top-rated tax firm, have answered 25 common questions about S corporations. You can find them at the end of this guide.

Whether you're just starting out or looking to optimize your existing business structure, this guide will help you understand the key aspects of S corporation taxation and the steps to electing this tax status.

What is an S corporation?

An S corporation is a particular type of corporation recognized under Subchapter S of the Internal Revenue Code. It functions similarly to a traditional corporation, with several critical distinctions in its tax treatment.

S corporation is not an entity type but a tax classification. You can not form an S corp, but you can select your business to be taxed as such.

By electing an S corporation tax status, a business can pass corporate income, losses, deductions, and credits through to shareholders. This election avoids double taxation on corporate income and provides significant tax benefits.

Looking to optimize your business taxes? Book a tax consultation with a CPA!

Learn more and bookHow is an S corporation taxed?

S corporations are taxed as pass-through entities for tax purposes, meaning that an S corporation itself does not pay income taxes. Instead, income, deductions, and credits are passed through to shareholders, who report these amounts on their personal tax returns.

When you own an S corporation or an LLC taxed as an S corporation, you can receive a salary for the work you perform for your business and distributions from your company's profits.

Paying yourself a reasonable salary

The IRS requires that S corporation owners who are also employees pay themselves a reasonable salary. This salary must be comparable to those paid for similar services in similar businesses.

Failure to do so can result in the IRS reclassifying distributions as wages, which would be subject to payroll taxes.

Taxation of S corporation distributions

Distributions to shareholders from an S corporation are generally not subject to self-employment tax. Instead, the distributions are taxed at the shareholder level based on their individual tax rates.

S corporation distributions are usually tax-free to the extent of the taxpayer's basis since they were already taxed on your individual return.

If you take a distribution that exceeds the stock basis, it will be subject to a capital gains tax. The tax will depend on how long the stock has been held, and the distribution will be categorized as either a short-term or long-term capital gain.

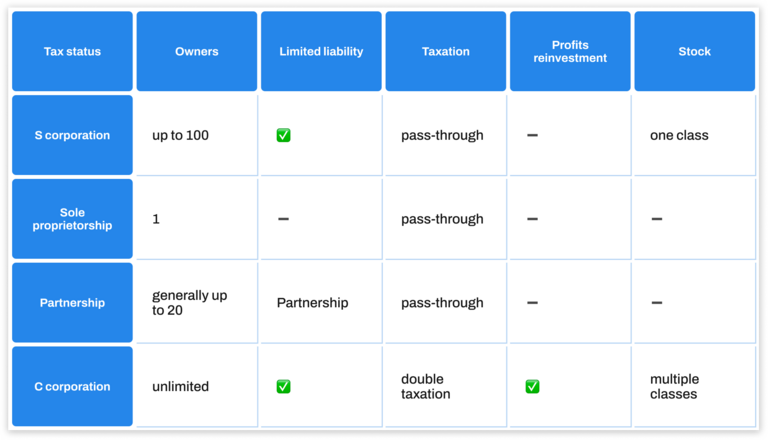

How do S corporations differ from other tax classifications?

S corporation vs. sole proprietorship

A sole proprietorship has no legal distinction between the owner and the business. Sole proprietors face unlimited personal liability and report all income and expenses on their individual tax returns.

In contrast, S corporations offer liability protection and potential tax advantages by avoiding self-employment tax on distributions.

Pro tip. The sole proprietorship is best when you are just starting out. Remember that you'll have to pay self-employment taxes on your company income.

Learn more about the differences between these two tax classifications for small businesses in our article S corporation vs sole proprietorship: What tax classification to choose?

S corporation vs. partnership

Partnerships are pass-through entities where income is reported on partners' personal tax returns. However, partnerships generally require each partner to pay self-employment tax on their share of income.

Pro tip. Strict rules for distributing profits do not constrain partners, so you can freely decide how to share them.

S corporations can provide tax savings by reducing the amount of income subject to self-employment tax through distributions.

S corporation vs. C corporation

C corporations face double taxation, where income is taxed at the corporate level and again at the shareholder level when dividends are distributed.

S corporations avoid double taxation by passing income directly to shareholders to be taxed at individual rates.

C corporations have no ownership restrictions, while S corporations have limitations, such as a maximum of 100 shareholders.

Pro tip. If you plan to reinvest all or most of the business profits back into the business, a C corporation might be a good option for you.

5 steps to start an S corporation

To start an S corporation, you'll need to:

- Incorporate your business: File articles of incorporation with your state.

- Apply for an EIN: Obtain an Employer Identification Number from the IRS.

- Meet eligibility requirements: Ensure all shareholders meet S corporation eligibility criteria.

- Elect S corporation status: File Form 2553 with the IRS within two months and 15 days after the start of the tax year you want the S corporation status to take effect.

- Register with state and local agencies: After electing S corp status with the IRS, it's essential to comply with state and local filing requirements to operate legally.

If you miss the deadline to file Form 2553, you may still apply for a late election by demonstrating a reasonable cause for the delay.

Carefully structuring your business entity can lead to substantial tax savings in the long run. However, it's crucial to take into account the initial costs and tax regulations when deciding on an S corp tax status. For instance, if you opt for an S corp tax election as a C corporation, your entity will be subject to the built-in gains (BIG) tax.

How to file taxes for an S corporation?

To file taxes for an S corporation, complete and submit Form 1120-S. This form reports the corporation's income, deductions, and credits.

Each shareholder must receive a Schedule K-1, which details their share of the corporation's income, deductions, and credits to be reported on their personal tax returns.

S corporation tax returns for the 2024 tax year are due by March 17, 2025. If the S corporation's fiscal year differs from the calendar year, the return is due on the 15th day of the third month following the end of the fiscal year.

How to minimize your S corporation tax liability?

Minimizing S corporation tax liability involves strategic tax planning to optimize your tax benefits and ensure compliance with IRS regulations.

Here are several key strategies:

Pay reasonable salaries

One of the most crucial steps in minimizing S corporation tax liability is paying reasonable salaries to shareholders who are also employees. The IRS requires that shareholder-employees get reasonable compensation for the services they provide to their business. By balancing salaries and distributions, you can optimize tax benefits.

Maximize deductions

Maximizing deductions is another effective way to lower your S corporation's taxable income. Ensure that all business expenses are properly supported with documentation.

Key areas to focus on include:

- Operating expenses: Regular business expenses such as rent, utilities, supplies, and insurance should be tracked and deducted.

- Depreciation: Utilize depreciation methods to deduct the cost of significant business assets over time.

- Home-office deduction: You can deduct a portion of your home expenses if you use part of your home exclusively for business purposes.

Plan distributions

Properly planning distributions can help manage the corporation's and shareholders' tax liabilities.

Consider the following strategies:

- Timing: Schedule distributions during the tax year to manage personal tax liabilities effectively.

- Retained earnings: Retain earnings within the corporation to prepare for future expenses, which can also help manage cash flow and tax liabilities.

Contribute to retirement plans

Retirement plans are a beneficial strategy to reduce taxable income while planning for the future.

Establishing and contributing to retirement plans can provide significant tax advantages:

- 401(k) plans: Contributions to 401(k) plans are tax-deductible, reducing the taxable income of your S corporation.

- Profit-sharing plans: These plans can provide flexibility in contributions and help reduce taxable income while benefiting employees.

Implementing these strategic tax planning methods can minimize your S corporation's tax liability, optimize financial performance, and ensure compliance with IRS regulations.

Always consult with a tax professional to tailor these strategies to your business needs and stay updated on any tax law changes.

Focus on your business. Partner with professionals for taxes.

Book discovery callS corporation taxes: 25 FAQs answered by tax pros

S corporations are taxed as pass-through entities, meaning they do not pay corporate income taxes. Instead, all income, losses, deductions, and credits are passed through to the shareholders, who report these items on their individual tax returns.

S corporations may be subject to certain built-in gains taxes and passive income taxes if they exceed specified thresholds.

S corporation distributions are not subject to self-employment tax. Instead, shareholders pay taxes on their share of the S corporation's income, regardless of whether distributions are actually made. These distributions are considered a return on investment and are tax-free to the extent of the shareholder's basis in the stock.

If distributions exceed the shareholder’s basis, the excess is taxed as a capital gain. Proper salary payments to shareholder-employees must be ensured to avoid IRS penalties.

S corporation tax returns (Form 1120-S) are due by March 17, 2025 (for the 2024 tax year). If the S corporation’s fiscal year differs from the calendar year, the return is due on the 15th day of the third month following the end of the fiscal year.

To file an S corporation tax return, complete and submit Form 1120-S, which reports the corporation’s income, deductions, and credits. Each shareholder must receive a Schedule K-1, which details their share of the corporation's income, deductions, and credits, to be reported on their personal tax returns.

The tax returns and schedules can be filed electronically through the IRS system. To avoid delays or penalties, ensure all required forms and schedules are included.

The main form is Form 1120-S. Each shareholder receives a Schedule K-1.

Additionally, an S corporation may need to file Form 941 for payroll taxes, Form 940 for federal unemployment taxes, and state-specific forms as required.

S corporation tax returns are typically filed electronically through the IRS e-file system. If filing by mail, the address depends on the corporation's principal business location. Specific mailing addresses are listed in the Form 1120-S instructions.

Always consider using certified mail or a private delivery service to confirm receipt.

File Form 7004 to request an automatic six-month extension. To get an extension, submit the form by the original tax return due date. Note that this extension applies only to the filing deadline, not to any taxes owed. Payment of estimated taxes should be made by the original due date to avoid interest and penalties.

With an approved extension, the S corporation tax return (for the 2023 tax year) is due by September 15, 2024.

No, S corporations do not pay federal corporate income taxes.

Yes, S corporations must make quarterly estimated tax payments for income taxes if the corporation expects to owe $500 or more in taxes for the year. These payments include estimated taxes on behalf of the shareholders for their share of the income, as well as employment taxes for salaries paid to employees, including shareholder-employees.

Shareholders may also need to make their own quarterly estimated tax payments based on their share of the corporation's income.

Generally, S corporations do not receive Form 1099 for services rendered as they are exempt. However, they may receive 1099 forms for other types of payments, such as rent, interest, or dividends.

No, you can not file personal and S corporation taxes together. S corporations must file Form 1120-S separately, reporting the business's income, deductions, and credits. Each shareholder then reports their share of the corporation's income, as detailed in Schedule K-1, on their personal tax returns.

You should generally keep the S corporation tax records, including income tax returns, financial statements, and all supporting documentation, for at least seven years.

Certain records, such as those related to asset purchases and sales, should be kept for as long as they are relevant plus the statute of limitations period.

No, S corporations themselves do not pay self-employment tax. Instead, shareholders who work for the corporation receive salaries subject to payroll taxes, including Social Security and Medicare taxes.

No, S corporation income is not subject to self-employment tax. Shareholders report their share of the corporation's income on their personal tax returns. While they must pay income tax on this amount, they do not pay self-employment tax on distributions.

However, reasonable salaries paid to shareholder-employees are subject to payroll taxes.

Yes, S corporation owners who are also employees must pay federal and state unemployment taxes on their salaries.

The corporation is responsible for paying the employer's portion of these taxes. This ensures that S corporation shareholders-employees are covered by unemployment insurance.

Yes, tax-exempt income increases an S corporation shareholder's stock basis.

S corporation losses pass through to shareholders, who can deduct them on their personal tax returns, subject to basis, at-risk, and passive activity loss limitations. This can offset other income, potentially reducing personal tax liability.

Shareholders must have sufficient basis in their stock and loans to the corporation to deduct the losses.

There’s no established tax rate for S corporations. Shareholders pay tax on their share of the income at their individual tax rates.

No, an S corporation can not pay an individual's personal taxes. Such payments would be treated as additional compensation, dividends, or loans, each with different tax implications.

Yes, an LLC can elect to be taxed as an S corporation for federal tax purposes while retaining its legal structure.

To elect an LLC to be taxed as an S corporation, file Form 2553 with the IRS. You must submit the form no more than two months and 15 days after the start of the tax year in which the election is to take effect. The LLC must also meet all S corporation eligibility requirements.

The choice between an LLC and an S corporation for tax purposes depends on various factors, including income level, number of owners, and administrative preferences. S corporations can offer tax savings through reduced self-employment taxes on distributions, while LLCs provide more flexibility in ownership and profit distribution.

An S corporation can have up to 100 shareholders.

No, an S corporation can not be a shareholder in another S corporation. Shareholders of an S corporation must be individuals, certain trusts, and estates.

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. Always consult with a tax professional regarding your specific case.

Ines Zemelman, EA, is the founder and president of TFX, specializing in US corporate, international, and expatriate taxation. With over 30 years of experience, she holds a degree in accounting and an MBA in taxation. See more

Further reading