Schedule K-1 Form 1120-S: Simple guide for S corp owners

As an S corporation owner, it is important to understand your tax obligations. One key form you need to be familiar with is Schedule K-1 (Form 1120-S).

This guide will help you navigate the complexities of 1120-S Schedule K-1 to ensure compliance and maximize available deductions and credits.

What is Schedule K-1?

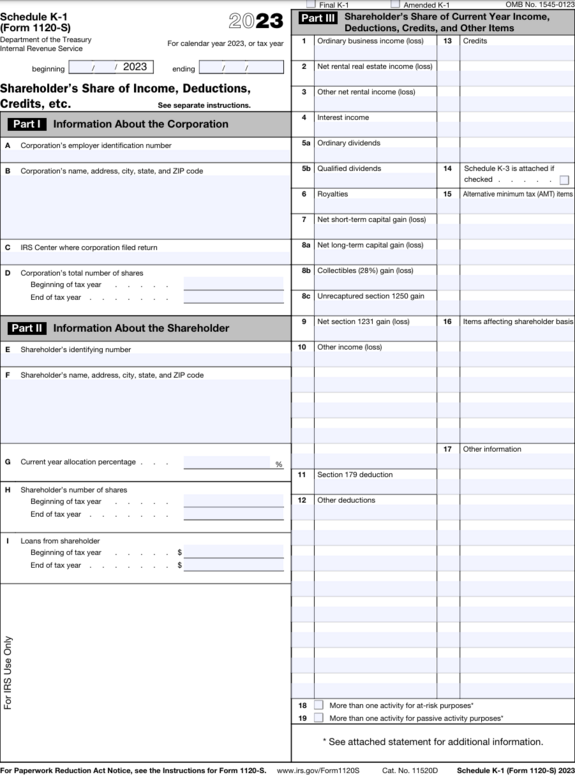

Schedule K-1 is a tax document used to report each shareholder's share of an S corporation's income, deductions, credits, and other financial information.

It is an integral part of Form 1120-S, the annual tax return that S corporations file with the IRS. The form breaks down the corporation's financial activities into portions attributable to each shareholder, allowing them to accurately report their share on their individual tax returns.

Components of Schedule K-1

Part I: Information About the Corporation

This section includes the S corporation's name, address, and Employer Identification Number (EIN). It also shows the type of entity and the IRS filing year.

Part II: Information About the Shareholder

This section collects the shareholder's identifying information, including the shareholder's name, address, and taxpayer identification number (TIN). It also shows the shareholder's percentage ownership for the year.

Part III: Shareholder's Share of Current Year Income, Deductions, Credits, and Other Items

This is the most detailed section where the S corporation reports the shareholder's allocated share of various financial items. Key items include:

- Ordinary business income (loss): The primary income or loss from the corporation's operations.

- Net rental real estate income (loss): Income or loss from real estate rental activities.

- Interest income: Income earned on interest-bearing accounts or investments.

- Dividend income: Income received from stock dividends.

- Capital gains (losses): Gains or losses from the sale of capital assets.

- Deductions, such as Section 179 expensing: Allowable deductions that may reduce taxable income.

Requirements for filing and reporting

For the S corporation

The S corporation must file Form 1120-S annually, along with a completed Schedule K-1 for each shareholder. This form must be filed by the 15th day of the third month following the end of the corporation's tax year (usually March 15 for calendar year filers).

Filing steps for the S corporation:

- Complete Form 1120-S. Gather all necessary financial information for the fiscal year.

- Prepare a Schedule K-1 for each shareholder. Ensure that each shareholder's share of income, deductions, and credits is accurately reported.

- File Form 1120-S and Schedule K-1 with the IRS. File electronically or by mail by the due date.

- Distribute copies of Schedule K-1 to shareholders. Provide each shareholder with an individual Schedule K-1 for tax reporting.

For shareholders

Individual tax returns, particularly forms 1040 or 1040-SR. The filing deadline is usually April 15, but extensions can be requested.

Reporting steps for shareholders:

- Review the Schedule K-1. Make sure all information is accurate and matches your records.

- Report income and deductions on Form 1040. Transfer the relevant information from Schedule K-1 to your personal tax return.

- Include required schedules. Depending on the type of income or deduction, you may need to attach additional forms, such as Schedule E for rental income or Schedule D for capital gains.

- File your individual return. Submit your completed tax return by the due date or file for an extension if necessary.

Common mistakes to avoid

One of the most common mistakes made when completing Schedule K-1 is providing inaccurate information. This can be due to clerical errors, outdated records, or a misunderstanding of the form's requirements.

Tips to avoid mistakes:

- Verify names, addresses, tax identification numbers, and financial information.

- Make sure all shareholder information is current.

- When in doubt, consult a tax professional.

Avoid surprise taxes and penalties.

Get a tax planning consultation.

Benefits of accurate reporting

Maximize deductions and credits

Accurate reporting on Schedule K-1 ensures that shareholders can take full advantage of all available deductions and credits. By correctly identifying and claiming these items, shareholders can reduce their taxable income and overall tax liability.

For example, the Section 179 deduction allows immediate expensing of qualified property.

The business expense deduction reduces the amount of taxable income.

Also read. S corporation tax benefits

Avoid penalties

Accurate and timely reporting helps avoid IRS penalties and interest. The IRS imposes penalties for late filing, underreporting of income, and failure to provide accurate information.

How to avoid penalties:

- Meet all filing deadlines.

- Make sure all information you report is accurate and complete.

- Keep abreast of tax laws and regulations that may affect your filings.

Bottom line

Understanding and accurately completing Schedule K-1 is essential for S corporation owners and their shareholders. By following this guide, you can ensure compliance, optimize your tax benefits, and maintain good standing with the IRS.

For complex situations, consider consulting with a tax professional to navigate the intricacies of your specific circumstances.

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. Always consult with a tax professional regarding your specific case.

Ines Zemelman, EA, is the founder and president of TFX, specializing in US corporate, international, and expatriate taxation. With over 30 years of experience, she holds a degree in accounting and an MBA in taxation. See more

Further reading

![Guide to S corp taxes [+ 25 FAQs answered by tax pros]](https://tfxstorageimg.s3.amazonaws.com/5ive22zs5rfzfaniwnoxx88emcud)